Brand and digital marketing

Business Strategy

Bridge the Gap: How to Align Business Metrics with Investor Priorities on Customer Value and Acquisition Costs

February 29 2024

At a Glance:

- Improving the LTV:CAC ratio is crucial for long-term business sustainability.

- The challenges in understanding and optimising these metrics lie with the inconsistent definition and methodologies, limitations in data collection and the lack of integration between systems.

- We explore below what actions investors and businesses can take to bridge the gap and improve decision-making for long-term growth.

LTV:CAC has a considerable impact on strategic decision making and longer-term sustainability

In the intricate world of investments and business operations, understanding and optimising customer lifetime value (LTV) and acquisition costs (CAC) is highly compelling. A better customer lifetime value to customer acquisition cost (LTV:CAC) ratio is a sign of long-term sustainability for a business. It also informs crucial decision making on go to market (GTM), budget prioritisation, facilitates expansion with confidence, and often highlights potential operational inefficiencies (e.g., ineffective targeting, high churn rate leading to low LTV).

LTV and CAC are difficult to operate with due to inconsistent definitions & priorities, limited data collection beyond directly measurable areas, and disconnect between measurement systems

Collaborating with both investment firms and businesses highlights several factors which contribute to the complexity surrounding customer value and acquisition costs:

🔷 Inconsistent Definition of Success

LTV and CAC calculations are complex and the calculation methodology itself varies between different businesses. This is usually due to differing levels of data quality, variances in timeframes and the distinction between new and existing customers.

Even internally, the definition of a conversion or what success looks like can differ between teams, leading to different priorities. For example, an acquisition team’s focus on lead acquisition can have little understanding of the quality that the lead management team focuses on, and does not account for the refund post transaction which matters to the commercial team.

The inconsistent calculation methodologies make it difficult to determine at first glance if the CAC is appropriately balanced compared to a customer’s ‘true value’ to ultimately generate profit. This then has a knock on effect on a business’ ability to operate with these metrics in mind.

🔷 Lack of Data Collection Beyond Directly Measurable Areas

In order to calculate CAC and LTV, the data needs to be reliable, however both essential tagging and detailed channel-based data collection are often lacking. One eCommerce client had channel-based data collection in place, and were reporting and optimising with that data. However, the channel segmentation only accounted for 50% of their total customers, so they were operating with only half of the picture in mind.

Even with accurate tracking, many businesses find it difficult to gather data beyond directly measurable areas such as paid media. Teams end up laser focussed on channels like paid search and businesses are then hit hard by any changes in costs from the ad platforms without a diverse cross-channel strategy in place. The limitation in data insights for awareness initiatives restricts the ability to answer critical questions about what drives consumer intent in the first place, and diverts attention away from this area.

Without comprehensive and accurate tracking mechanisms, businesses struggle to measure and evaluate the effectiveness of individual channels and strategies.

🔷 Disconnect Between Measurement Systems

There is often a lack of integration between the technology and tools in use across different parts of a business, with the ability to make connections between the tools either not available or not integrated.

Managing and leveraging customer relationship management (CRM) systems remains a persistent challenge for numerous businesses. Although ad bidding platforms are improving connections with customer databases, many businesses are rightly concerned about data privacy and legal implications, as we all navigate the decline of traditional tracking methods like cookies. These integration challenges result in a lack of comprehensive data for accurate calculations and informed decision-making.

The combination of differing calculation methodologies and lack of data sufficiency for these calculations is at the heart of the disconnect for using CAC and LTV in practice. This hampers decision-making processes for budget sufficiency, strategic allocation and optimisation of that budget. Consequently, scalability and expansion opportunities are adversely affected.

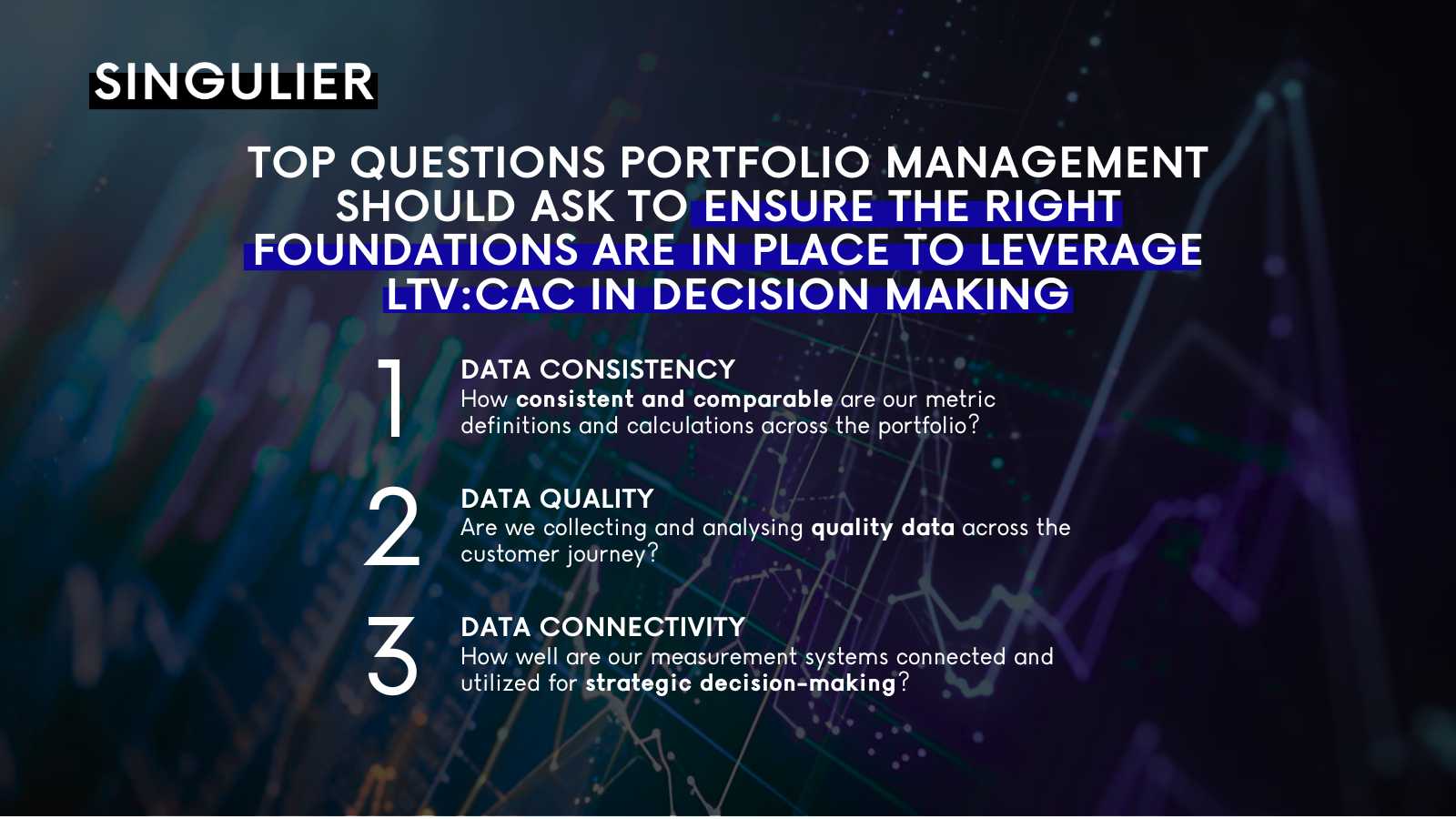

Bridging the gap: set common definitions, enrich data collection and connect measurement systems

To operate within the realm of customer value and acquisition costs more effectively and combat existing limitations, businesses and investors should focus on three key areas:

🔷 Set Common Definitions Overseen by One Stakeholder

Consistency is key. Define and consistently use the same calculation methodology for customer lifetime value and acquisition costs to enable accurate comparisons internally and to industry benchmarks. Business strategies can then be more accurately aligned with investment expectations.

This can, and should, be brought together by a senior stakeholder (e.g., commercial director) to liaise with heads of departments, and ensure consistency across the board. In addition, support educational initiatives and training programs within the business to help teams gain a deeper understanding of customer value, acquisition costs, and the impact on long-term profitability. Teams who are more knowledgeable are better equipped to make informed decisions within their individual departments.

🔷 Enrich Data Collection

Invest in robust tracking and customer data tools to gather detailed, accurate data (e.g., granular naming convention on tagging, customer IDs) . Focus on expanding data collection efforts beyond the bottom funnel and paid media. Leverage and integrate customer insights, surveys, and behaviour analysis to better understand consumer motivations throughout the entire customer journey. Explore options for econometrics or market-mix modelling to prove the value of cross-channel initiatives.

For example, working with a global consumer healthcare brand, pulling insights together across brand awareness surveys, market-mix-modelling, digital channels and sell out data helped to connect the dots across the whole path to purchase. Having the right tools in place can significantly improve measurement and evaluation.

🔷 Connect Measurement Systems

Allocate resources towards tools and technology that facilitate integration and data accuracy to ensure seamless data flows, most commonly between media buying platforms, lead management platforms, CRM and customer databases. This will aid reporting dashboards and actionable insights to enhance the management and interpretation of critical metrics. Furthermore, ensure you have the right profiles within the business to troubleshoot any issues, and facilitate and oversee these systems.

For example, we helped a B2C business link their media activation to their lead management system via unique identifiers to measure spend and results through the lead conversion process. The integration between the tools allowed more accurate calculations for CAC and LTV.

By addressing the challenges and embracing these proactive strategies, both investors and businesses can bridge the gap between the importance of LTV:CAC and effective utilisation for long-term business success. A willingness to adapt to evolving technologies and methodologies will pave the way for improved decision-making and sustainable growth in the dynamic world of business.

Reach out to our team of experts to discuss your LTV:CAC performance, and explore strategies to bridge the gap between the calculations and operational execution.

Speak to our experts:

SAM YU-HSUAN LIN

Director at SINGULIER

[email protected]

KITSON SYMES

Partner at Singulier

[email protected]

About Christina Ahmed

Digital Media Expert Manager