Brand and digital marketing

Transaction Advisory

Churn as a GTM Driver: Using Customer Exits to Sharpen Acquisition

November 12 2025

Churn is one of the most scrutinised SaaS metrics, yet in a Singulier due diligence for a client with B2B platforms serving Micro Businesses and SMBs, we’ve found that it’s less a measure of loss than a source of insight.

Each exit reveals something about ICP alignment and GTM fit. Viewed this way, churn becomes a diagnostic tool for directing growth towards segments that deliver fast payback and proven ROI.

Singulier has undertaken an in-depth analysis of customer churn within the SaaS industry, leveraging a robust combination of customer surveys, interviews with key market stakeholders, and advanced consumer insight methodologies. Explore the insights below.

Rethinking the Churn Narrative

High churn in SMB-focused platforms is often structural, not symptomatic. Up to 45% of churn stems from business closures or pivots, which are factors outside platform control. These exits define the limits of segment fit. GTM strategy should recognise this volatility and focus on customers with greater retention and lifetime value (LTV) potential.

Why Context Matters: Churn as Input for GTM Levers

Churn analysis is ultimately segmentation. While 20–30% annual churn is typical for SMBs, the GTM focus should shift toward the mid-Market and Enterprise segments, where churn rates of 10–15% and 2–8%, respectively, drive stronger Net Revenue Retention (NRR). The aim isn’t to reduce churn everywhere but to prioritise best-fit users, who are the ones who scale successfully on the platform.

With this in consideration, Churn should be treated as a feedback loop instead of a red flag. What matters is what departures reveal about the effectiveness of a GTM strategy.

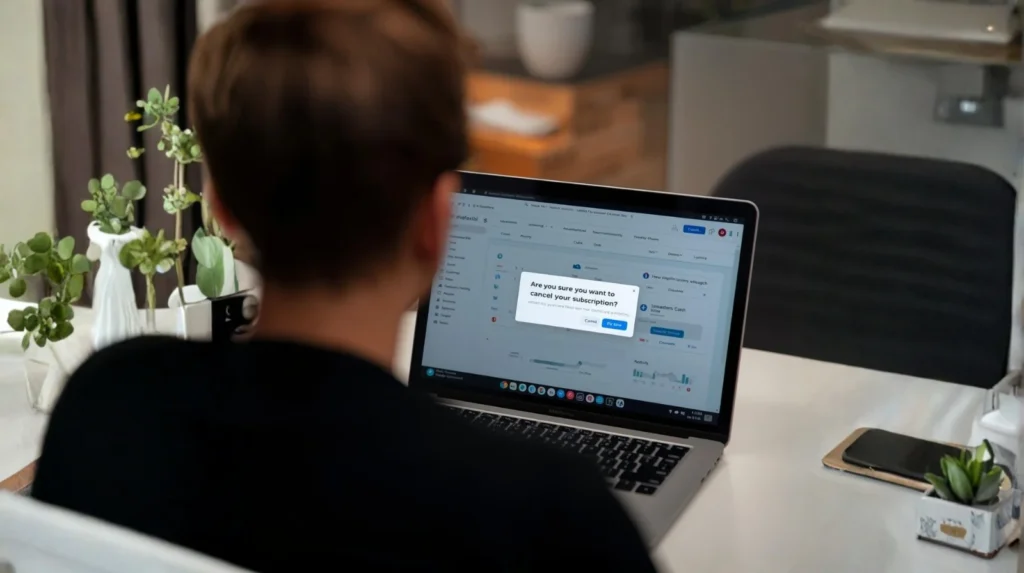

How to Make Your Customers Stay: Note the 2-4 Month Intervention Window

High-performing retention requires proactive intervention within the critical pre-cancellation window. Our study shows that churners typically exhibit normal usage for up to two months before gradually disengaging. App usage data shows visible decreases (in visits) starting around Churn month -2 and Churn month -1.

Based on this engagement pattern data, the strategy must focus on detecting these pre-cancellation dips:

- Automated Monitoring: Implement usage-based intelligence to monitor declining feature engagement after initial use automatically. The system should specifically flag any customer whose activity drops significantly 2–4 months before their expected renewal or cancellation date.

- CS Triggers: When an engagement dip is detected, this should trigger specific, targeted interventions by the Customer Success (CS) team, focusing on ongoing onboarding and education to accelerate value realisation.

By detecting disengagement early, timely interventions can be carried out to ultimately prevent cancellations and enhance customer retention, building a more qualified and loyal audience.

Opportunities for Mitigation

Analysis suggests that around a third of churn is directly addressable through targeted GTM action. To pre-empt this, mitigation efforts must be specific, directly linking the initiatives to addressable churn they target:

- Addressing Lack of Sales Pipeline Features: This is a primary driver for B2B players. The initiative is to enhance product depth by adding a sales pipeline management feature. This aims to position the platform as a comprehensive, all-in-one solution and reduce the switch to market leaders.

- Addressing Integration & Customisation Needs: This impacts B2C players (seeking brand-specific chat experiences) and small/medium companies that are scaling. The recommended initiative is to increase integration & customisation capacities.

- Addressing Limited Perceived Value & Demographic Churn: Customers often only recognise the chatbot, missing the full feature breadth. Mitigation involves improving discovery/nurturing through tailored campaigns (like nurturing emails) that showcase diverse capabilities, boosting retention with a value-driven solution. Additionally, encouraging Yearly subscription plans helps lock in long-term commitment and predictability.

- Addressing Deliverability Issues: This key driver for B2C companies requires improving email capabilities.

These interventions turn churn analysis into an investment tool. Each improvement compounds across acquisition, expansion, and retention, turning insights from customer exits into a roadmap for more durable growth and higher-quality revenue.

What the Best Platforms Do Differently in Response to Churn

Examining top-performing platforms, they don’t view churn as an afterthought in operations. Instead, they leverage churn insights to continually improve GTM strategies. They identify the following churn prevention tools as best practices:

1. Feature Gating/Segmentation-led Development: prioritising features that support retention and expansion of their most valuable cohorts rather than catering to edge cases. They also leverage annual contracts and deeper integrations to increase switching costs, strengthening alignment with stickier mid-market strategies.

2. Usage-Based Intelligence (Alerting/Early Disengagement Detection): actively monitoring engagement dips, enabling quick intervention and informed action based on data.

3. Nurturing Programs (Continuous Onboarding): ensuring continuous onboarding and education remain central, sustaining adoption and reducing preventable churn long after activation through in-app guidance, targeted campaigns, and tailored content.

By tightening retention levers and reducing preventable loss, these leading platforms improve Net Revenue Retention (NRR), lower acquisition pressure, and allocate capital more efficiently toward the customers most likely to scale.

Strategic Takeaways: Churn as the ICP Clarifier

The value of churn analysis lies in what it teaches about focus, fit, and future growth.

- Not all churn is negative: Structural churn defines the natural boundary of a viable segment.

- Actionable churn is strategic: Product gaps, pricing friction, and onboarding failures expose the most immediate levers to improve NRR.

- Segmentation drives efficiency: GTM investment should follow retention and LTV data, not just acquisition potential.

- Every exit informs the ICP: Each churn event strengthens understanding of who the platform serves best, and why.

Ultimately, churn is a mirror for GTM maturity. The platforms that outperform use it to clarify their ICP, optimise capital allocation, and strengthen their path to sustainable growth.

Let’s Talk

If your GTM model needs sharper segmentation, retention analysis, or churn diagnostics, our GTM offer helps PE-backed platforms turn customer data into actionable growth levers: aligning product, pricing, and acquisition strategy for measurable impact.

About Henri Knyphausen

Partner, DACH

Henri Knyphausen is a Partner at Singulier, advising private equity funds and their portfolio companies on scaling B2B platforms, process optimisation, and driving digital transformation across industrial and healthcare sectors.

About Singulier Insights

Singulier Global Marketing Team