Business Strategy

Transaction Advisory

Create a Compelling Equity Story and Maximise Valuation with Singulier’s Exit Readiness Offer

March 13 2024

Singulier’s Exit Readiness Offer helps private equity funds navigate the exit process and create a sustainable roadmap for growth to maximise their valuation upon exit.

A successful exit is made difficult when having to navigate a complex and changing macroeconomic climate. In the last year, deal activity has slowed down due to rising interest rates and prolonged inflationary pressure, spurring a shift from dependence on multiples to prioritising real value creation in portfolios. Simultaneously, tech, data, and digital advancements are moving at a record pace, increasing pressure on businesses to adapt or be left behind. In today’s world, GPs are increasingly having to orchestrate a balancing act between careful prioritisation and fearless acceleration to succeed. Singulier’s unique exit readiness offer, equipped with our digital, data, and tech expertise, addresses this gap.

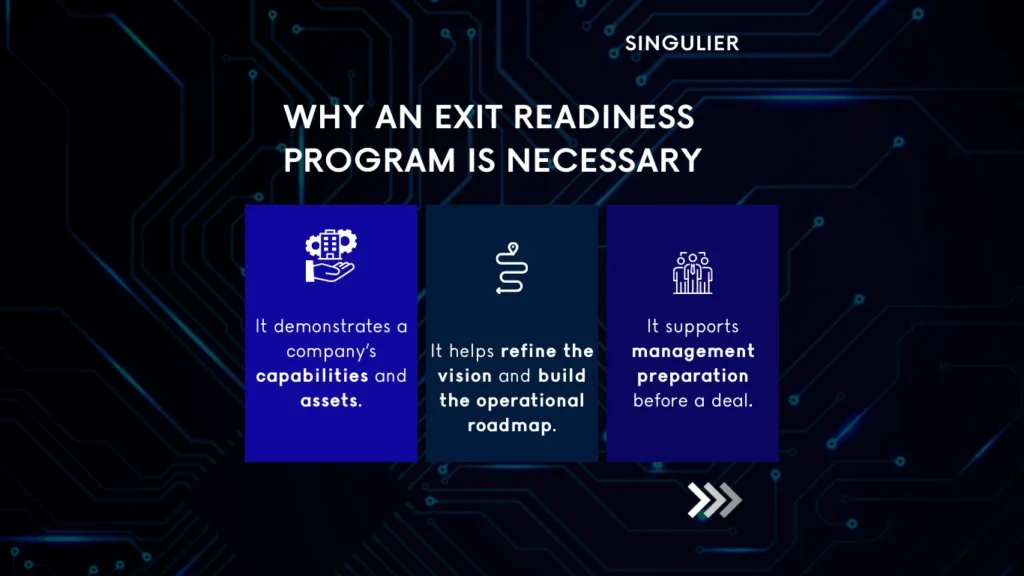

An Exit Readiness project is about comprehensive preparation that enhances a company’s appeal to prospective buyers. Our Exit Readiness offer are designed to address the following business challenges during exit:

- Developing an actionable exit strategy for immediate implementation

- Enhancing competitive edge, refine business plans, growth strategies, and operational efficiency for market leadership

- Crafting an engaging equity story to captivate prospective investors with a convincing investment case

- Empowering management to adeptly identify and address digital and tech gaps in the business strategy

- Accelerating the VDD process for a smoother, quicker exit transaction

- Ultimately, maximizing the company’s valuation at the point of exit

Who It’s For and When to Launch

An Exit Readiness project is beneficial for current investors and portfolio management who seek to validate the management’s strategic vision and build a sustainable value creation plan for their portfolios

Timing is crucial – an Exit Readiness project should be launched 4 to 18 months before the planned exit to allow for sufficient time for tangible results.

Strategic Expertise Meets Data and Technology

At the heart of Singulier’s approach is the fusion of strategic expertise with a data and technology-led framework, supported by our team of operational and strategic experts alongside our data analytics platform and data engineering and infrastructure teams. This combination enables the creation of a compelling exit narrative, focusing on sustained value creation across digital, data, tech and AI.

Singulier’s approach emphasises the integration of digital and technological strategies in the core business model, ensuring that companies are not just prepared for an exit but are also positioned to leverage the latest AI and technological advancements for sustained growth.

In conclusion, Singulier’s Exit Readiness Offer is more than just a tool to enhance exit valuations. It’s a comprehensive operational roadmap that fosters a culture of sustained growth and transformational innovation, built with co-ownership alongside your portfolio’s operational teams . Singulier’s strategic insights, combined with a data and technology-led approach, help private equity funds achieve successful exits and prepare companies for the future. This approach will become increasingly indispensable in the dynamic landscape of private equity, especially with advancements in AI and data analytics.